Tumwater- Thursday, the Let’s Go Washington citizen action group turned in 424,890 papers to give people in Washington the option to not pay the Long-Term Care Tax (LTC), which is run by the state.

At a press conference on Thursday in front of the Secretary of State’s Office, Brian Heywood signed Initiative 2124. “The huge lies that are being told that this somehow takes away long-term care health…this is a complete and total lie; all this does is give people a choice,” he said.

Almost two-thirds of people in Washington State said that the long-term care payroll tax should be gotten rid of in 2019 through an advisory vote.

Washington politicians were the first in the country to put in place a long-term care payroll tax for people who don’t have private long-term care insurance. The tax caps payments at $35,500 per person, per year, adjusting for inflation. Long-term care costs that are covered include nursing care, home modifications like wheelchair ramps, home-delivered meals, and paying family workers back.

The LTC payroll tax deduction was signed into law by Governor Jay Inslee in 2019 and was supposed to start on January 1, 2022. However, after public outcry, the Washington State Legislature pushed it back 18 months and decided it would start on July 1, 2023. The last day to apply for a tax exemption was December 31, 2022. Those who qualify will start getting rewards in 2026.

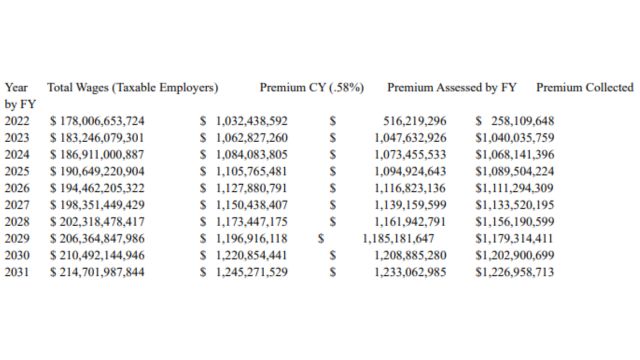

The program is paid for by a 0.58 percent payroll tax on all employee wages, which amounts to an average of $471.22 per worker per year based on salary data from the Office of Financial Management for 2021. Unlike some other state insurance plans, there is no limit on wages. The long-term care payroll tax is charged on all income and other forms of pay, such as stock-based pay, bonuses, paid time off, and severance pay.

The fiscal report for HB 1087, the bill that passed the LTC payroll tax and was backed by House Speaker Laurie Jinkins, says that the program’s Washington Cares Fund should get at least $500 million by the end of 2023 and another $1.07 billion by the end of 2024. The schedule for protected income that needs to be put into the long-term services and support trust account is shown below:

Some people who are against LTC say that the benefits are not portable and that the funding is not enough for Washington’s aging population, since AARP says that the average yearly cost of in-home care for one person is $42,000 and the cost of a private nursing home is $144,000. This means that people who pay into the program but then move out of state will not be able to get their LTC payments until they pay into the program again for another ten years straight. Also, the WA Cares Fund only helps the taxpayer. It does not help a spouse or a child.

“A mega-millionaires self-funded campaign just filed an initiative to the Legislature (I-2124) that would in effect repeal WA Cares, a long-term care benefit for more than 3 million working Washingtonians,” Percussion Strategic said in a statement against Let’s Go Washington’s plan. “Health and service groups like AARP Washington, the MS Society, the Lupus Foundation, the Alzheimer’s Association, the Washington Health Care Association, and other members of the We Care For WA Cares coalition support WA Cares in a big way.”

Read More: Virginia Resident Scores Jackpot with $2 Million Powerball Win

At the moment, Percussion Strategic is working with a number of groups that are against this and other Let’s Go Washington efforts.