In recent weeks, vessels traversing the Red Sea have encountered attacks from Houthis based in Yemen, prompting shipping companies to alter their routes.

This shift has resulted in a notable increase in freight rates.

As ships opt for extended detours around the Cape of Good Hope in South Africa, ocean freight rates have surged by as much as $10,000 per 40-foot container.

Container ships have redirected over $200 billion worth of goods away from the Red Sea to avoid potential strikes by Houthi militants.

On Monday, the US-owned commercial vessel, the Gibraltar Eagle, fell victim to an attack by Houthi militants, as reported by the US Central Command.

Some industry analysts anticipate that these disruptions may lead to a reversal in the fortunes of an industry that experienced a recession in the preceding year.

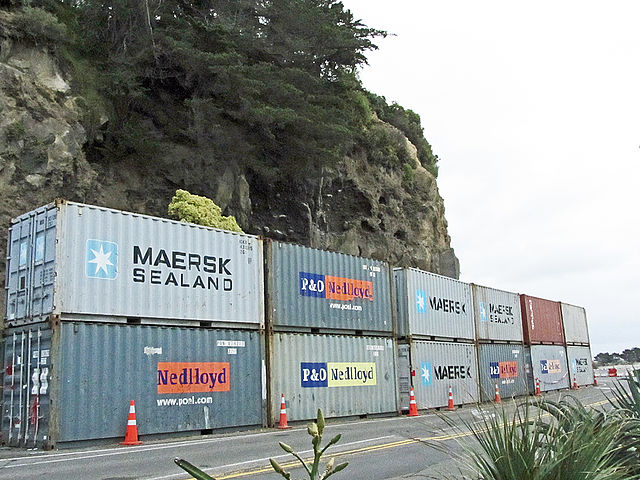

Alan Baer, the CEO of logistics company OL USA, conveyed via email to CNBC, “Regarding the elevated rates in 2024, even if this situation persists for just another two or three weeks, it could contribute multiple billions to the bottom line of Vessel-Operating Common Carriers (VOCC).” VOCCs, including prominent entities such as Maersk, Evergreen, and COSCO, are ocean carriers that own and operate vessels, overseeing cargo management and transportation.

Red Sea Tensions Dampen Rate Reduction Prospects

With the escalation of tensions in the Red Sea, marked by the US and Britain launching strikes against Houthi targets and the rebel group vowing retaliation, the likelihood of rates diminishing in the near future is diminishing.

Brashier, Vice President of Drayage and Intermodal at ITS Logistics, observed that both contracted rates for ocean carriers and spot market rates may experience further increases.

Contracted rates, presently under negotiation, typically become effective between January and March each year, remaining fixed for the entire calendar year.

Brashier also noted that the upcoming Chinese Lunar New Year may contribute to rate increases before the holiday closures.

Traditionally, this period witnesses a surge in exports from Asia as businesses strive to transport additional freight ahead of the temporary shutdown lasting at least two weeks.